Top Picks: 15 Real Estate Investment Trusts (REITs) Wall Street Analysts Can't Get Enough Of

Table of Contents

- 2024 Financial Advisor RIA Rankings | Curi RMB Capital

- Top REITs - Commercial Property Executive

- Top REITs To Buy For 2021 | Seeking Alpha

- 10 Of The Best REITs To Buy For 2024 | Seeking Alpha

- 50 Top US REITs By Gains And Yield In April | Seeking Alpha

- TOP 4 REITs / Best REITs to Invest in the Philippines / REITs Investing ...

- 9 of the Best REITs to Buy for 2024

- REIT Investments in India - Random Dimes

- REIT Investments in India - Random Dimes

- ALL NEW 2025-2026 PORSCHE K1 -- Full-Sized Luxury Electric SUV ! - YouTube

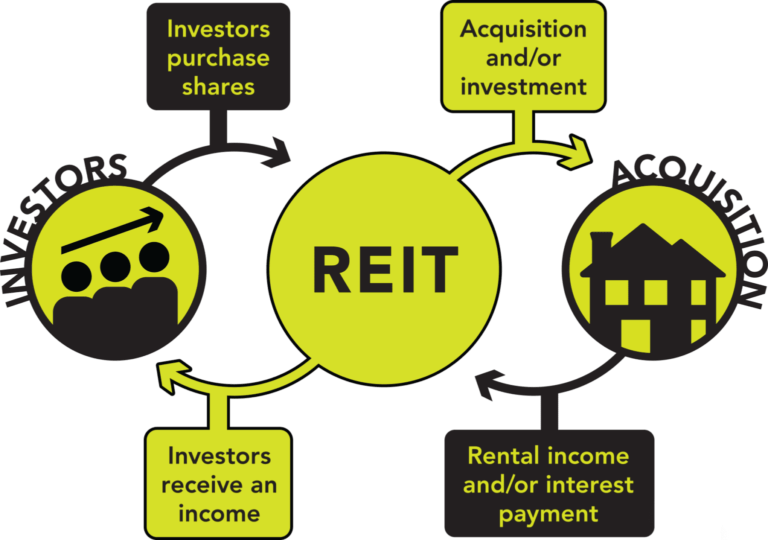

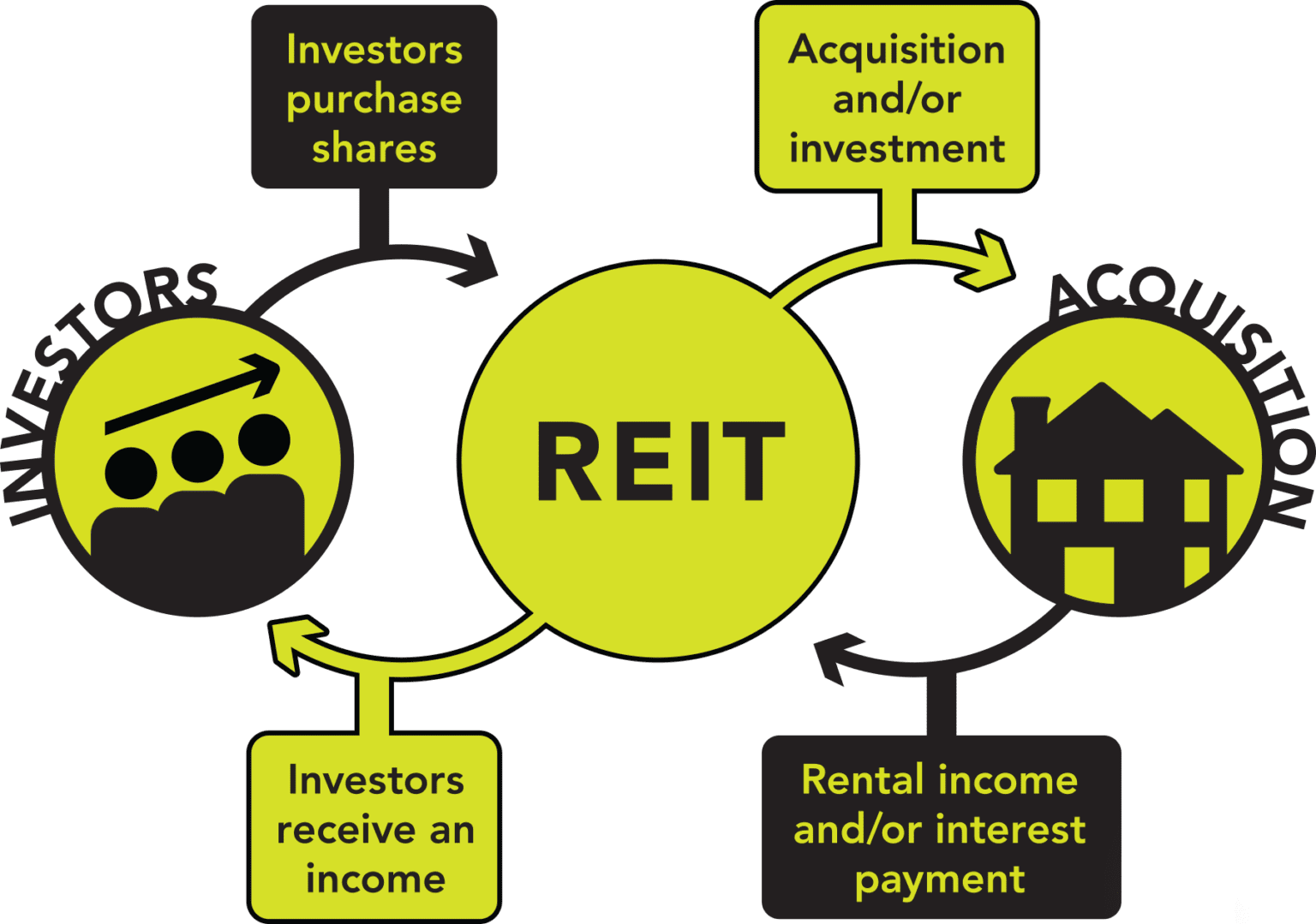

REITs allow individuals to invest in real estate without directly managing properties. They offer a unique opportunity to benefit from the real estate market's performance, making them an attractive addition to any investment portfolio. With so many REITs to choose from, it can be challenging to determine which ones are the best. That's why we've compiled a list of the top 15 REITs that Wall Street analysts are recommending.

Here are the Top 15 REITs:

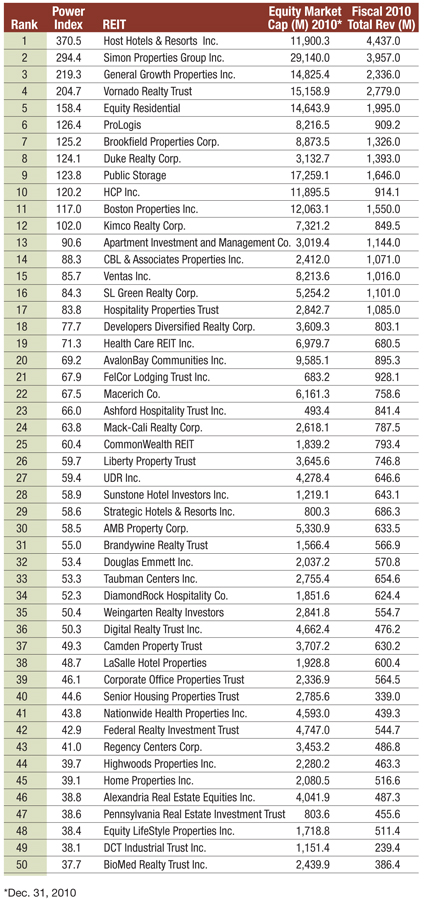

- Simon Property Group (SPG): As one of the largest shopping mall REITs, Simon Property Group is a favorite among analysts due to its strong portfolio and potential for growth.

- Realty Income (O): With its diversified portfolio of commercial properties, Realty Income is a top pick among analysts for its consistent dividend payments and long-term growth potential.

- National Retail Properties (NNN): This REIT's focus on retail properties and strong track record of dividend payments make it a popular choice among analysts.

- Ventas (VTR): As a leading healthcare REIT, Ventas is well-positioned for growth in the rapidly expanding healthcare industry.

- Welltower (WELL): With its focus on healthcare and senior housing properties, Welltower is a top pick among analysts for its potential for long-term growth.

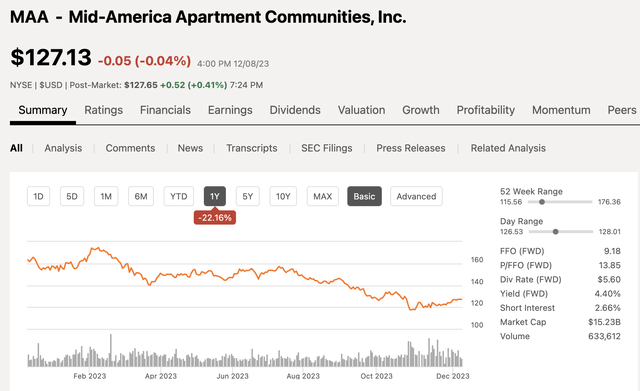

- Mid-America Apartment Communities (MAA): This apartment REIT's strong portfolio and potential for growth in the multifamily sector make it a favorite among analysts.

- Equity Residential (EQR): As one of the largest apartment REITs, Equity Residential is a top pick among analysts for its strong portfolio and potential for long-term growth.

- AvalonBay Communities (AVB): With its focus on luxury apartments, AvalonBay Communities is a popular choice among analysts for its potential for growth in the high-end multifamily sector.

- Digital Realty Trust (DLR): As a leading data center REIT, Digital Realty Trust is well-positioned for growth in the rapidly expanding tech industry.

- Crown Castle International (CCI): This tower REIT's strong portfolio and potential for growth in the wireless communications sector make it a top pick among analysts.

- American Tower (AMT): With its focus on tower properties, American Tower is a favorite among analysts for its potential for long-term growth and strong dividend payments.

- Prologis (PLD): As a leading industrial REIT, Prologis is well-positioned for growth in the rapidly expanding e-commerce industry.

- Duke Realty (DRE): With its focus on industrial and office properties, Duke Realty is a top pick among analysts for its potential for long-term growth and strong dividend payments.

- Healthcare Realty Trust (HR): This healthcare REIT's strong portfolio and potential for growth in the rapidly expanding healthcare industry make it a popular choice among analysts.

- Iron Mountain (IRM): As a leading storage REIT, Iron Mountain is well-positioned for growth in the rapidly expanding data storage industry.

Why These REITs Stand Out

In conclusion, the top 15 REITs that Wall Street analysts love in today's market offer a unique opportunity for investors to benefit from the real estate market's performance. By investing in these REITs, you can potentially earn a steady income stream and benefit from long-term growth, making them an attractive addition to any investment portfolio.